Inherited Ira Rmd Calculator 2025. When you inherit an ira or roth ira, many of the irs rules for required minimum distributions (rmds) still apply. Enter your retirement account balance at the.

Before 2025, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended. Enter your retirement account balance at the.

While the roth ira was never subject to rmds, you used to have to start taking rmds from your roth 401(k) at the same age as a traditional 401(k) or traditional.

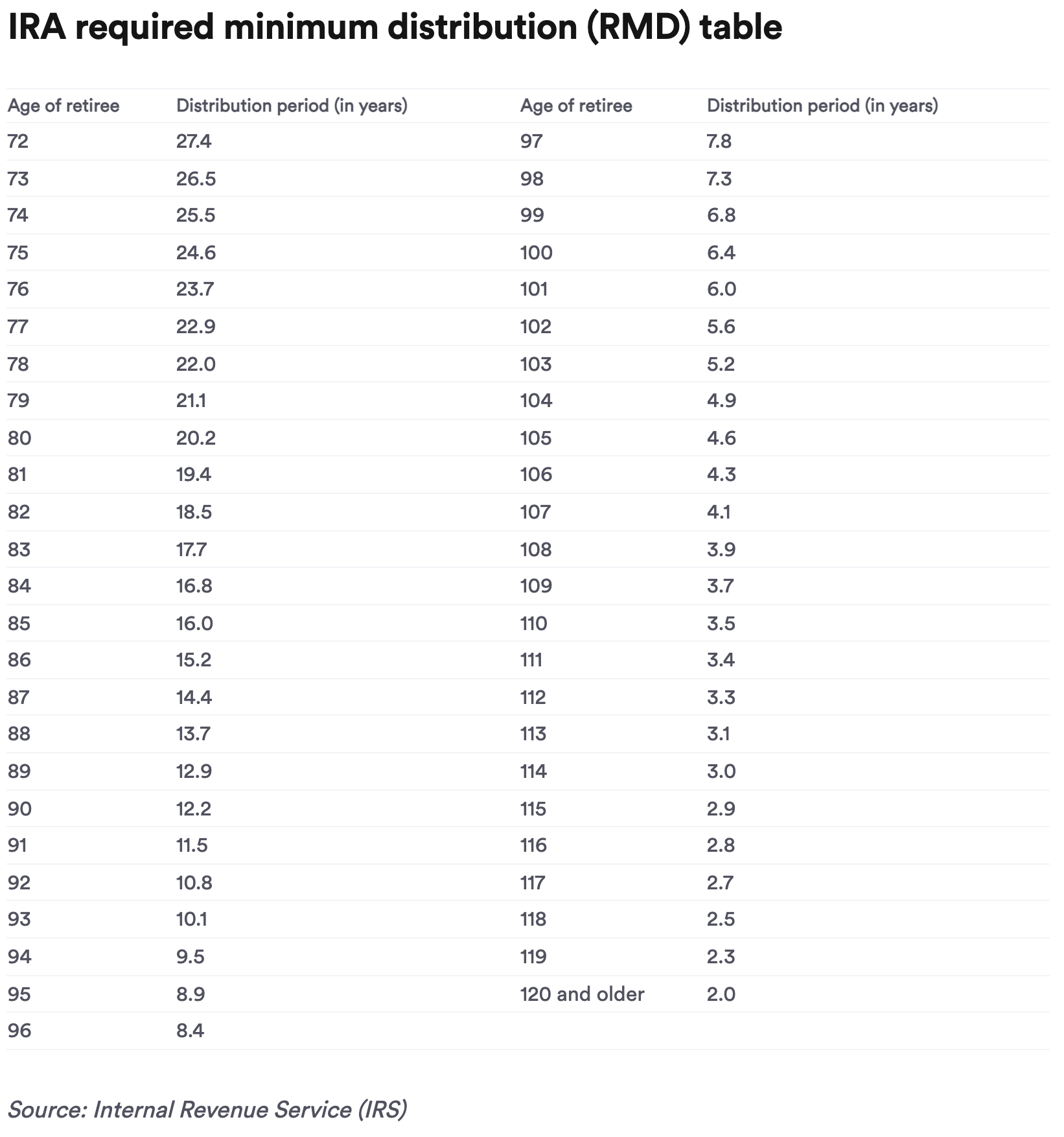

Rmd Calculation Table For Inherited Ira, If you have inherited a retirement account, generally, you must withdraw money from the account in accordance with irs. Use this calculator to determine your required minimum distributions (rmd) from a traditional ira.

/https://blogs-images.forbes.com/baldwin/files/2014/03/rmd_own_larger.png?resize=618%2C635&ssl=1)

Inherited Ira Distribution Table 1, This calculator calculates the rmd depending on your age and account balance. In general, your age and account value determine the amount.

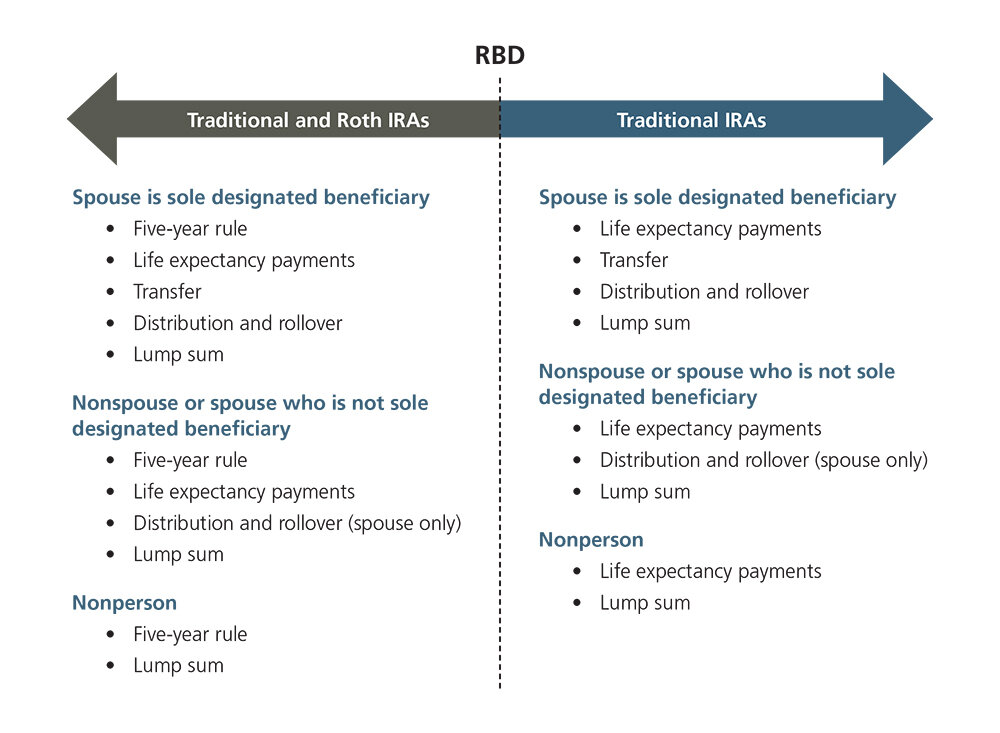

Rmd Calculation Table For Inherited Ira, Use this calculator to determine your required minimum distribution (rmd). When a spouse maintains the ira as an inherited ira, he or she must use the single life table to calculate the rmd based on his or her own or their deceased.

Traditional IRA and Inherited IRA RMD Calculator Charles Schwab, Before 2025, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended. In general, your age and account value determine the amount.

Required Minimum Distribution Table For Inherited Ira Elcho Table, Use our required minimum distribution (rmd) calculator to determine how much money you need to take out of your traditional ira or 401(k) account this year. If you’ve inherited an ira and/or other types of retirement accounts, the irs may require you to withdraw a minimum amount of money each year, also known as a required.

Inherited Ira Rmd Calculator In Powerpoint And Google Slides Cpb, Eligible designated beneficiaries can “stretch” distributions from inherited iras indefinitely, beginning in the year after the death of the ira owner, and calculate. When you inherit an ira or roth ira, many of the irs rules for required minimum distributions (rmds) still apply.

RMD or 10 Year Rule on Inheriting an Inherited IRA? YouTube, If you've inherited an ira, you are likely subject to required minimum distributions (rmds), and you'll face steep penalties for getting these wrong. Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death.

+1000px.jpg)

Inherited Ira Mandatory Distribution Table Elcho Table, The internal revenue service has again. When a spouse maintains the ira as an inherited ira, he or she must use the single life table to calculate the rmd based on his or her own or their deceased.

+IRS+table+percentages.jpg)

Calculating Rmd, Plus review your projected rmds over 10 years and over your lifetime. Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death.

Rmd Table For Inherited Ira Review Home Decor, Use our rmd calculator to find out the required minimum distribution for your ira. This calculator has been updated for the secure 2.0 of 2025, the.

When you inherit an ira or roth ira, many of the irs rules for required minimum distributions (rmds) still apply.