Tax Rates Ireland 2025. Income tax rates will stay the same (at 20%. Use our interactive calculator to help you estimate your tax position for the year ahead.

The rates of tax for cars registered after july 1, 2008 is based on the emissions of the engine. Last year saw bank of ireland post a record profits haul of €1.9bn before tax, with net interest income fuelled by the ecb’s aggressive interest rate campaign soaring.

Effective tax rates after Budget 2025 Social Justice Ireland, The annual salary calculator is updated with the latest income tax rates in ireland for 2025 and is a great calculator for working out your income tax and salary after tax based on a. Tax rates and rate bands.

The Irish Taxation System trends over time and international, The standard rate band for income tax (the amount of income that is subject to tax at the 20% rate) is to be. The tax yield in 2025 is projected to grow to €92.6 billion of which corporation tax is projected at €24.5 billion.

Tax rates for the 2025 year of assessment Just One Lap, You are liable for lpt in 2025 if you own a residential property on 1. Last updated on 5 october 2025.

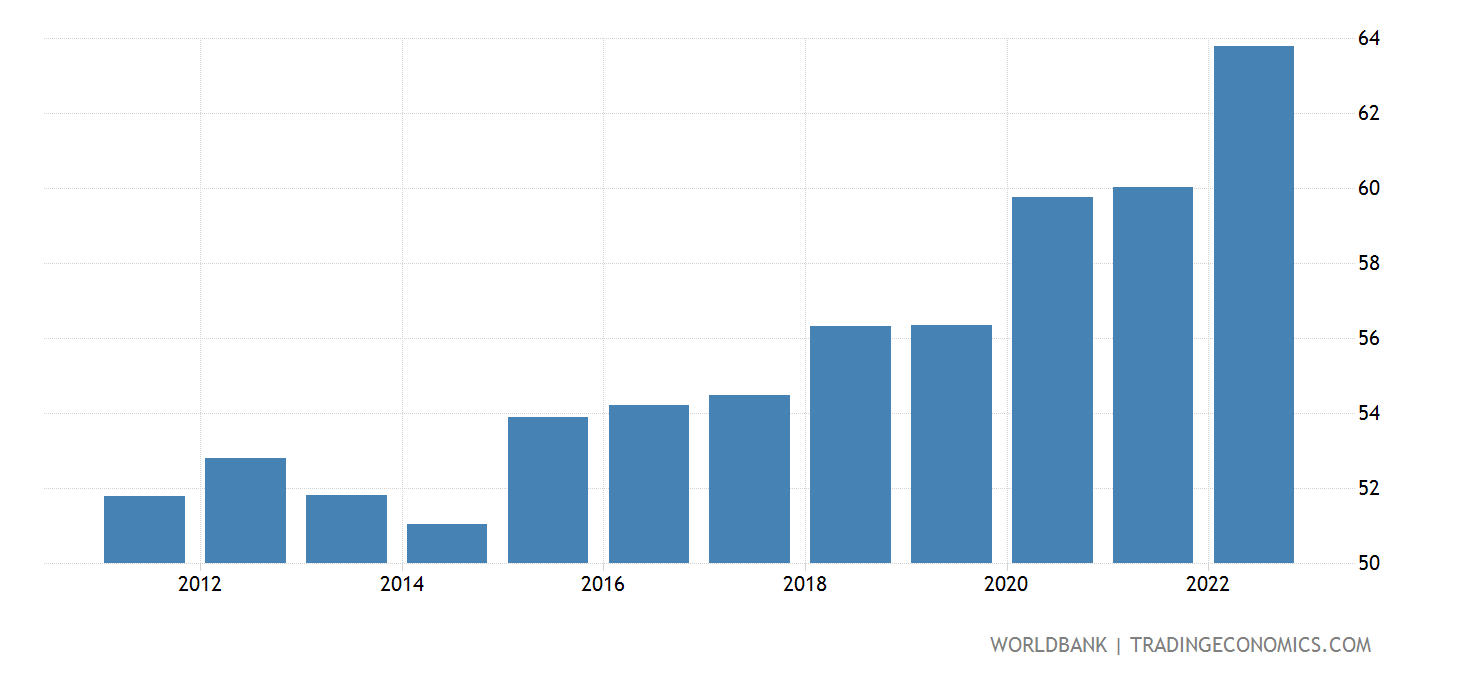

Ireland Taxes On Profits And Capital Gains ( Of Total Taxes, The rates of tax for cars registered after july 1, 2008 is based on the emissions of the engine. An annual local property tax (lpt) is charged on residential properties in ireland.

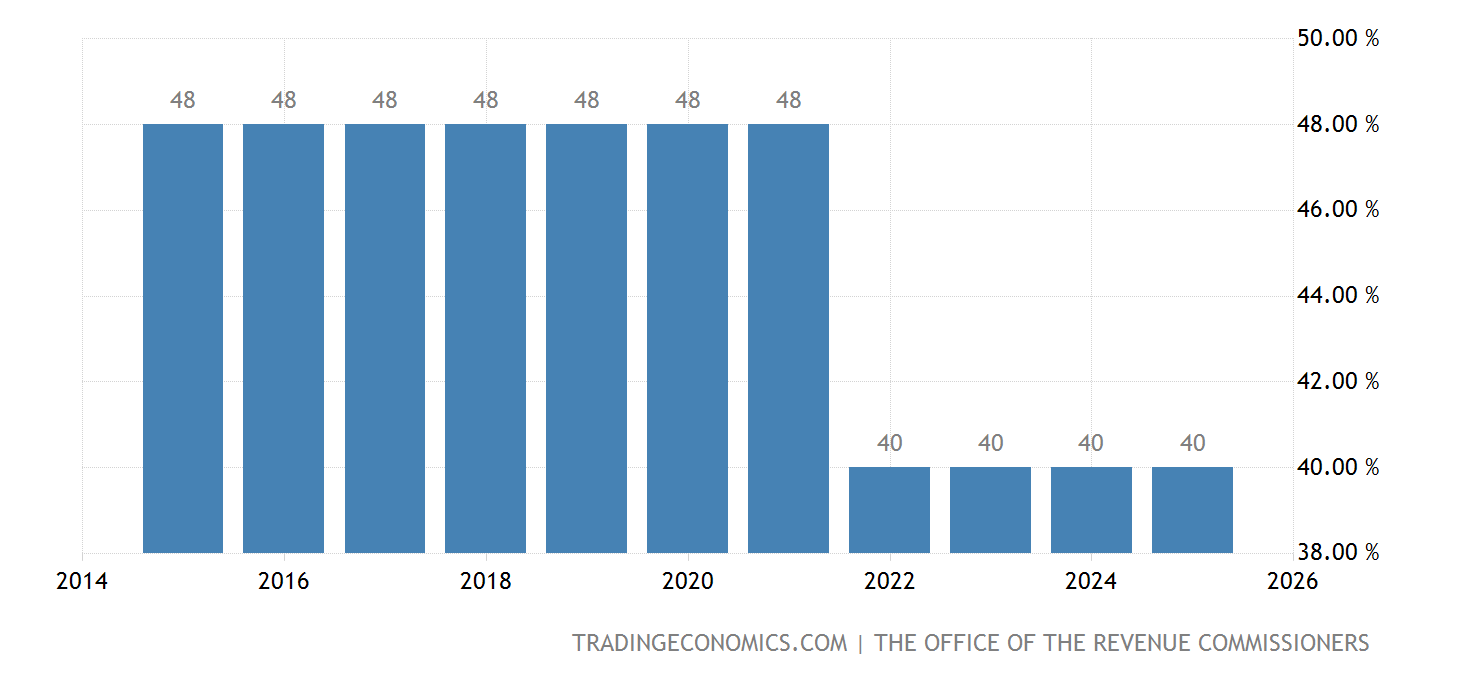

The Irish Taxation System trends over time and international, Calculate your income tax, social security and. An increase in the ceiling for the 2% rate of usc of €2,840 from €22,920 to €25,760.

Ireland Personal Tax Rate 2025 Data 2025 Forecast 1995, The tax yield in 2025 is projected to grow to €92.6 billion of which corporation tax is projected at €24.5 billion. A reduction the 4.5% rate of usc by 0.5% to 4.0%.

How to Estimate Your Tax for the current year, Last updated on 6 february 2025. As part of the plans.

Irs New Tax Brackets 2025 Elene Hedvige, The minister for finance has said he expects ireland's corporation tax rate will be increased to 15% in 2025 for large companies that are subject to last year's global. This rate applies to income between.

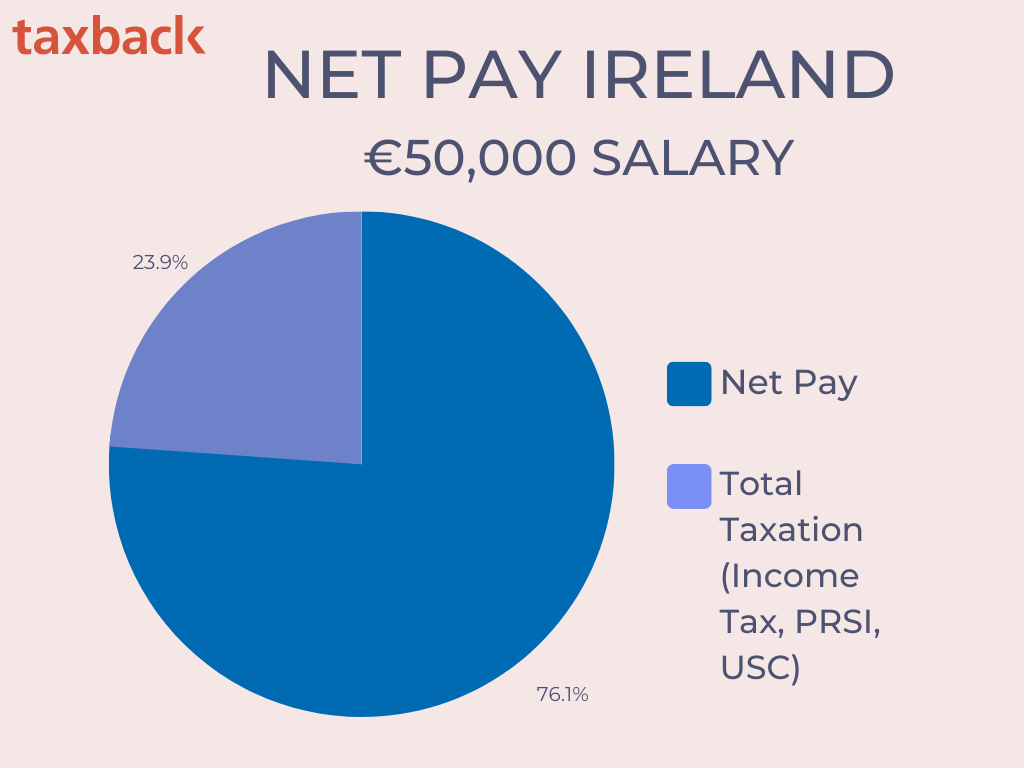

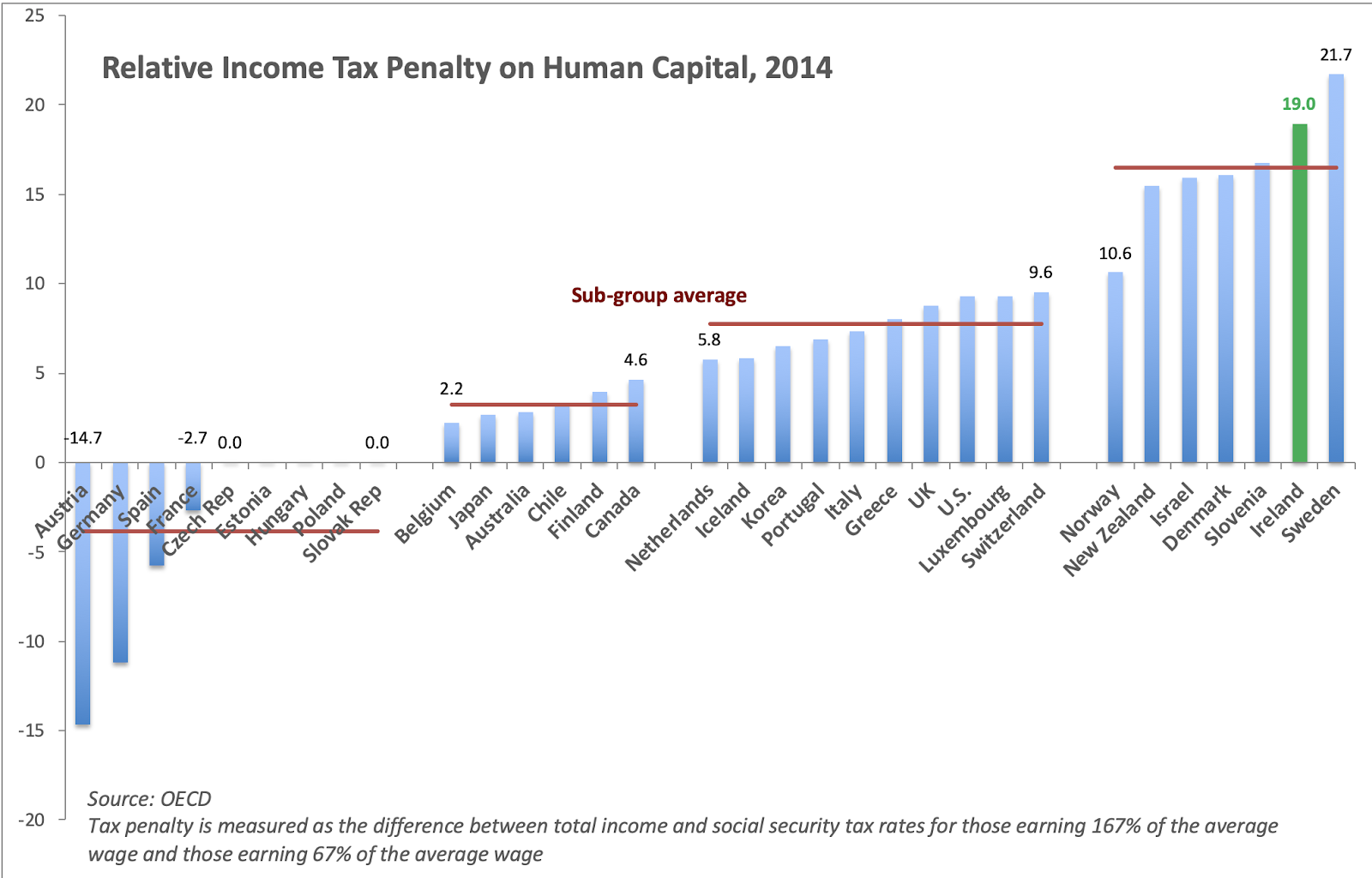

True Economics 9/9/19 Ireland and OECD Tax Rates Comparatives, Last updated on 6 february 2025. In 2025, for a single person with an income of €25,000 the effective tax rate will be 10.3%, rising to 16.9% for an income of €40,000 and 39.0% for an income of.

Irs Tax Brackets 2025 Vs 2025 Annis Hedvige, The minister for finance has said he expects ireland's corporation tax rate will be increased to 15% in 2025 for large companies that are subject to last year's global. This rate applies to income between.